Tracy, Balaton levies lead cities

Tracy, Balaton levies lead cities

By Seth Schmidt

Local units of government and school districts will soon be hosting “truth-in-taxation” public hearings and finalizing property tax levies for 2018.

How do real estate taxes and levies compare among different communities, school districts, and counties? Multiple factors contribute to how much property tax is owed on any given parcel of real estate.

Property tax levies set by local units of government are one factor.

Another is the assessed Estimated Market Value for each real estate parcel. The greater the value, the greater the property taxes that will be owed.

Different classes of real estate are another part of the tax formula. Commercial and industrial real estate is charged a greater tax rate than residential. Non-owner occupied residential properties, in turn, are charged a greater tax rate than owner-occupied housing that qualifies for the homestead exclusion. Agricultural property pays a rate that’s less than residential parcels. Business properties pay a state general tax.

Real estate taxes can also be affected by credits, voter-approved levies, and special assessments.

Municipal rates.

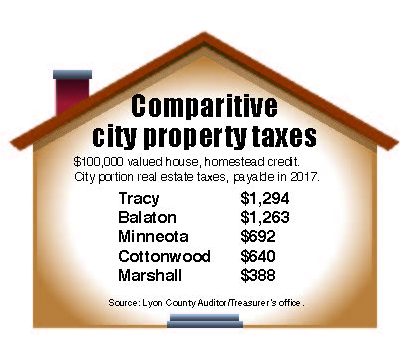

For real estate taxes payable in 2017, Tracy (pop. 2,120) and Balaton (pop. 570) had the highest municipal tax rates in Lyon County, with the exception of the much smaller communities of Florence and Garvin.

For more on this article, see this week’s Headlight-Herald.