By Seth Schmidt

The City of Tracy’s general fund balances are less than ideal, an auditor told the Tracy City Council last week.

“You are kind of at the low end,” said Tom Olinger, a CPA with the accounting firm of Abdo, Eick & Meyers, in reviewing the city’s 2017 audit report.

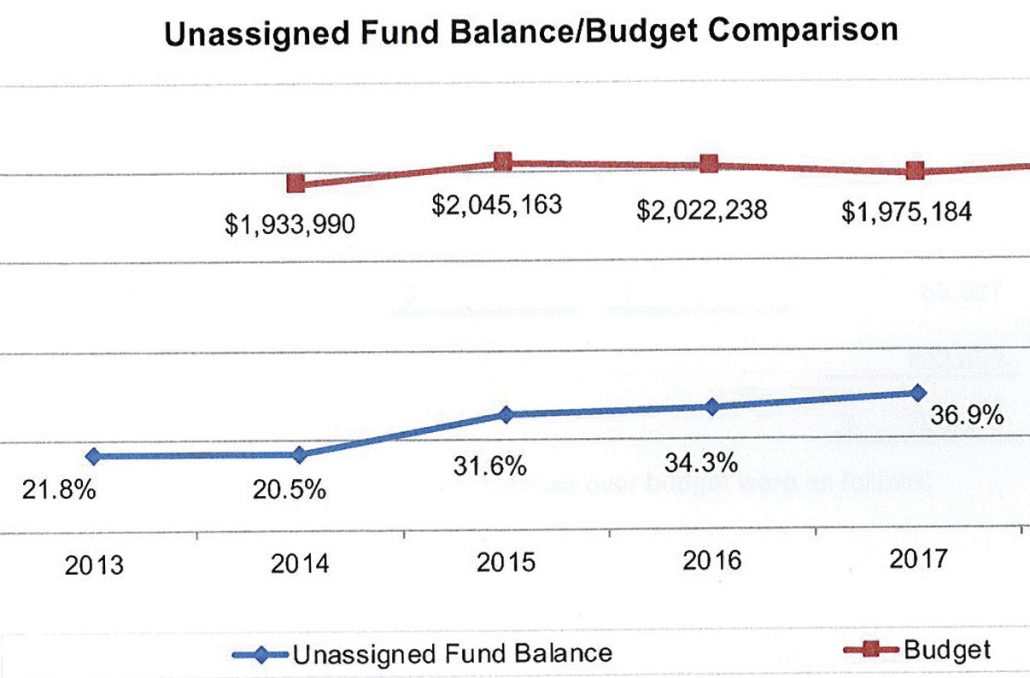

Tracy’s unassigned general fund budget balance at the end of 2017 stood at $750,463, which represented 36.9% of the 2018 general fund budget of $2,032,202.

The state auditor, Olinger said, wants that percentage to be between 35% and 50%.

A report issued with the audit stated that Tracy’s unassigned fund balances were less than average for similarly sized Minnesota communities. According to the state auditor’s office, in 2015 and ’16, the average general fund balance as a percentage of expenditures for towns with populations below 2,500 were 104% and 111% percent, respectively.

However, Olinger noted that Tracy has shown small increases in its general fund balances over the past five years. Since 2013, the percentage of general fund balances compared with the total budget has improved from 21.8% to 36.8% this past year.

Year-end 2017 figures showed a $73,417 fund balance increase over year-end 2016, when the unassigned fund balance was $677,046. The unallocated general fund balance at the end of 2016 was 34.3% of the general fund budget.

Olinger recommended the Tracy leaders continue to “edge upward the fund balance.” Having a greater fund balance, the accountant indicated, would put Tracy in a stronger cash-flow position. Adequate balances for cash flow, Olinger said, are important because the city receives most of its revenue (Local Government Aid and property taxes) twice a year.

Flat revenues

Olinger described general fund revenues as being “flat.” General fund revenues for 2015 were $2,090,842 compared with $2,056,155 in 2017. Revenues for 2017 were broken down into Intergovernmental (Local Government Aid), $1,024,510; property taxes, $790,608; miscellaneous, $80,684; charges for services, $69,375; transfers in, $41,118; licenses & permits, $26,317; fines & forfeits, $10,602; investment earnings, $8,893; special assessments, $4,048. Local Government Aid accounted for 49.8% of general fund revenues in 2017, with local property taxes contributing 38.5%

Spending

Tracy’s general fund spending declined slightly from $2,021,300 in 2016 to $1,990,648 last year.

Public safety, at $577,327, comprised 29.2% of general fund spending. Other general fund expenditures were general government, $422,277; streets & highways, $402,877; miscellaneous, $130,265; economic development, $56,034.

For more on this article, see this week’s Headlight-Herald.